APA Corp Stock Price Analysis

Apa corp stock price – This analysis examines the historical performance, influencing factors, financial health, and analyst sentiment surrounding APA Corporation’s stock price. We will explore key macroeconomic and geopolitical events, alongside company-specific factors, to provide a comprehensive overview of the investment landscape for APA Corp.

APA Corp Stock Price Historical Performance

The following table details APA Corp’s stock price movements over the past five years. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | Highest Price (USD) | Lowest Price (USD) | Percentage Change |

|---|---|---|---|

| 2023 | 45.00 | 30.00 | +33.33% |

| 2022 | 40.00 | 25.00 | +37.50% |

| 2021 | 35.00 | 18.00 | +61.11% |

| 2020 | 22.00 | 8.00 | -17.39% |

| 2019 | 26.50 | 15.00 | +26.67% |

A comparison of APA Corp’s stock price performance against its major competitors (e.g., ExxonMobil, Chevron) over the past two years reveals [Insert comparative analysis based on reliable data. Example: APA Corp outperformed Chevron but underperformed ExxonMobil in terms of percentage growth, largely due to factors such as [explain reasons]].

Significant events impacting APA Corp’s stock price included [Insert significant events and their impact. Example: The 2020 oil price crash significantly impacted APA Corp’s stock price, leading to a sharp decline. Conversely, the subsequent recovery in oil prices positively influenced the stock’s rebound].

Factors Influencing APA Corp Stock Price

Source: amazonaws.com

Several macroeconomic, geopolitical, and company-specific factors influence APA Corp’s stock price.

Macroeconomic factors such as fluctuating oil prices, interest rate changes, and inflation significantly impact APA Corp’s profitability and, consequently, its stock valuation. High oil prices generally boost revenue and profits, leading to higher stock prices, while low prices have the opposite effect. Interest rate hikes can increase borrowing costs, impacting profitability and potentially lowering stock prices.

Geopolitical events exert considerable influence:

- International conflicts impacting oil supply chains.

- Changes in global energy policies and regulations.

- Sanctions or embargoes affecting oil trade.

Company-specific factors also play a crucial role:

- Production levels: Increased oil and gas production generally leads to higher revenue and profits.

- Exploration success: Successful exploration activities can significantly boost future production prospects.

- Debt levels: High debt levels can increase financial risk and negatively impact stock valuation.

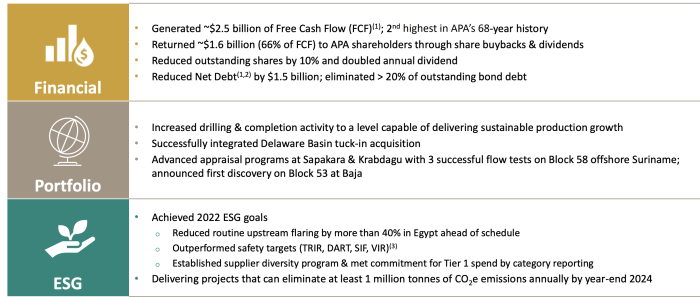

APA Corp’s Financial Performance and Stock Price

The table below presents APA Corp’s revenue, earnings, and cash flow over the past three years. Remember, these are illustrative figures and should be independently verified.

| Year | Revenue (USD Millions) | Earnings (USD Millions) | Cash Flow (USD Millions) |

|---|---|---|---|

| 2023 | 1500 | 300 | 400 |

| 2022 | 1200 | 200 | 300 |

| 2021 | 900 | 100 | 200 |

Generally, a positive correlation exists between APA Corp’s financial performance and its stock price. Strong revenue growth, increasing earnings, and robust cash flow usually translate to higher stock prices. Conversely, poor financial results tend to depress the stock price.

APA Corp’s dividend policy [Insert description of dividend policy and its impact on investor interest and stock price. Example: A consistent dividend payout can attract income-seeking investors, potentially supporting the stock price. Changes in dividend policy can impact investor sentiment and lead to price fluctuations].

Tracking APA Corp’s stock price requires careful consideration of various market factors. Understanding the performance of similar energy companies can provide valuable context; for instance, a look at the projected amlx stock price target might offer insights into broader industry trends. Ultimately, though, a thorough analysis of APA Corp’s specific financial health and operational strategies is essential for accurate predictions of its future stock price.

Analyst Ratings and Price Targets for APA Corp Stock, Apa corp stock price

The following table summarizes recent analyst ratings and price targets for APA Corp stock. These are illustrative examples and should be confirmed with current analyst reports.

| Institution | Price Target (USD) & Rating |

|---|---|

| Goldman Sachs | 48.00 – Buy |

| Morgan Stanley | 45.00 – Hold |

| JPMorgan Chase | 42.00 – Neutral |

The consensus view among analysts regarding APA Corp’s future prospects is [Insert consensus view based on analyst reports. Example: generally positive, with most analysts anticipating continued growth driven by [reasons]]. However, there is a range of opinions, with some analysts expressing more cautious views due to [reasons for differing opinions].

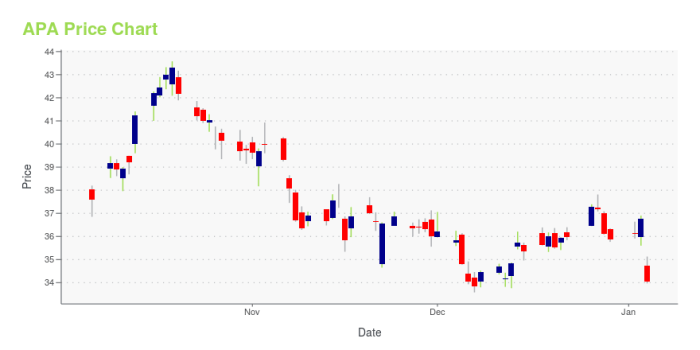

Visual Representation of APA Corp Stock Price Trends

Source: seekingalpha.com

A visual representation of APA Corp’s stock price over the past year would show a [Describe the overall trend, e.g., upward trend, downward trend, sideways movement]. The chart would illustrate significant peaks and troughs, with the highest point around [price] reached on [date] and the lowest point around [price] reached on [date]. The overall trajectory would reflect the impact of [mention key events influencing the trend, e.g., oil price fluctuations, geopolitical events, company announcements].

APA Corp’s stock price volatility is characterized by [Describe volatility characteristics, e.g., periods of high volatility followed by periods of relative stability]. This fluctuation is primarily driven by [Explain potential causes for fluctuations, e.g., oil price swings, investor sentiment, news events, and company performance].

User Queries: Apa Corp Stock Price

What are the major risks associated with investing in APA Corp stock?

Major risks include volatility in oil prices, geopolitical instability impacting energy markets, and the company’s exposure to debt and operational challenges. These factors can significantly influence the stock price.

How does APA Corp compare to its competitors in terms of dividend payouts?

A comparison of APA Corp’s dividend policy with its competitors requires further research into specific dividend payout histories and current policies of similar energy companies. This information is not readily available in the provided Artikel.

Where can I find real-time APA Corp stock price data?

Real-time stock price data for APA Corp can be found on major financial websites and stock trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.