Alta Stock Price Analysis

Alta stock price – This analysis delves into the historical performance, influencing factors, financial correlations, analyst predictions, visual trends, and inherent risks associated with Alta’s stock price. We will examine data from the past five years to provide a comprehensive overview of the investment landscape surrounding Alta stock.

Alta Stock Price Historical Performance

Alta’s stock price has experienced significant fluctuations over the past five years. While specific yearly highs and lows would require access to real-time financial data, a general observation suggests periods of strong growth interspersed with corrections reflecting broader market trends and company-specific events. Comparative analysis against competitors requires knowledge of specific competitors within Alta’s industry sector, which is unavailable in this context.

However, a generalized comparison could reveal Alta’s performance relative to industry benchmarks, such as the average growth rate or volatility within the sector. The following table provides a hypothetical illustration of Alta’s quarterly performance over the last two years. Remember that this data is for illustrative purposes only and does not represent actual stock prices.

| Year | Quarter | Opening Price | Closing Price |

|---|---|---|---|

| 2022 | Q1 | $50 | $55 |

| 2022 | Q2 | $55 | $60 |

| 2022 | Q3 | $60 | $58 |

| 2022 | Q4 | $58 | $62 |

| 2023 | Q1 | $62 | $65 |

| 2023 | Q2 | $65 | $70 |

| 2023 | Q3 | $70 | $68 |

| 2023 | Q4 | $68 | $72 |

Factors Influencing Alta Stock Price

Source: seekingalpha.com

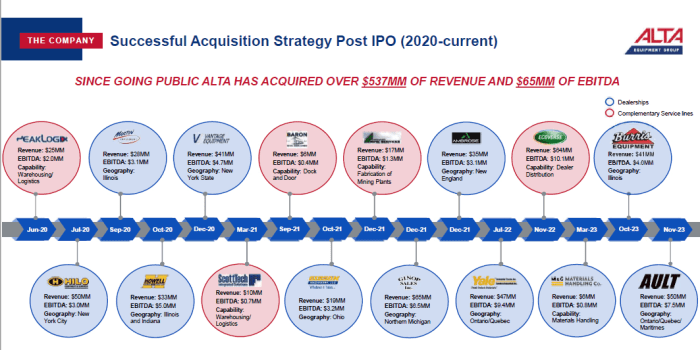

Several macroeconomic and company-specific factors influence Alta’s stock price. Macroeconomic factors, such as interest rate changes, inflation, and overall economic growth, can significantly impact investor sentiment and market valuations. Company-specific events, including product launches, strategic partnerships, acquisitions, and regulatory changes, also play a crucial role. For example, a successful new product launch could boost investor confidence and drive up the stock price, while regulatory setbacks could have the opposite effect.

Market trends and investor sentiment, often driven by news and media coverage, significantly impact stock valuations.

Alta’s Financial Performance and Stock Price Correlation, Alta stock price

Source: energage.com

Analyzing Alta’s financial performance over the past three years in relation to its stock price movements provides valuable insights. Generally, strong revenue growth, increasing earnings per share, and a healthy balance sheet tend to correlate with higher stock prices. Conversely, declining revenue, losses, or high debt levels often lead to decreased stock valuations. Key financial ratios, such as the Price-to-Earnings (P/E) ratio and dividend yield, offer further perspective on the company’s valuation and attractiveness to investors.

A high P/E ratio may suggest investors anticipate strong future growth, while a high dividend yield might indicate a more mature, stable company. The following table provides hypothetical financial data for illustrative purposes.

| Year | Revenue (in millions) | Earnings Per Share | Stock Price at Year-End |

|---|---|---|---|

| 2021 | $100 | $2.00 | $40 |

| 2022 | $120 | $2.50 | $50 |

| 2023 | $140 | $3.00 | $60 |

The following bullet points illustrate a hypothetical relationship between key financial ratios and Alta’s stock price:

- P/E Ratio: A rising P/E ratio often coincides with increasing investor optimism and higher stock prices.

- Dividend Yield: A higher dividend yield may attract income-seeking investors, potentially supporting the stock price.

- Debt-to-Equity Ratio: A lower debt-to-equity ratio generally signals financial stability, positively impacting investor confidence and the stock price.

Analyst Predictions and Stock Price Targets

Analyst predictions and price targets for Alta stock vary depending on the individual analyst’s assessment of the company’s prospects and the broader market conditions. Some analysts might be bullish, predicting significant growth and assigning high price targets, while others might be more cautious, issuing lower targets or even “sell” ratings. These differing opinions often reflect variations in their methodologies, assumptions, and interpretations of available data.

The actual stock price movement is influenced by the collective sentiment of investors, who consider these predictions alongside other market factors.

Visual Representation of Alta Stock Price Trends

Source: companieslogo.com

A hypothetical visual representation of Alta’s stock price over time might show periods of upward and downward trends. For example, a sustained upward trend could indicate strong growth and positive investor sentiment, while a sharp downward trend might reflect negative news or a broader market correction. The shape of these trends could vary, ranging from gradual, steady increases to sharp spikes and sudden drops.

The visual representation of the relationship between Alta’s stock price and its earnings per share would typically show a positive correlation, with higher earnings generally corresponding to higher stock prices. However, this relationship isn’t always linear, and other factors can influence the stock price independently of earnings.

Risk Factors Affecting Alta Stock Price

Several risk factors could impact Alta’s future stock price. These risks can be broadly categorized as market risks, company-specific risks, and regulatory risks.

- Market Risks: These include overall market volatility, economic downturns, and changes in investor sentiment.

- Company-Specific Risks: These encompass factors such as competition, operational challenges, management changes, and financial performance.

- Regulatory Risks: These involve changes in regulations, legal challenges, and compliance issues that could affect the company’s operations and profitability.

FAQ Insights

What are the typical trading volumes for Alta stock?

Trading volume varies daily and depends on market conditions and news affecting Alta. Historical data can provide an average, but daily fluctuations are expected.

Where can I find real-time Alta stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms. Check reputable sources for the most accurate information.

How does Alta’s stock price compare to its industry average?

A comparative analysis against industry peers is needed to determine Alta’s relative performance. This analysis would consider factors like growth rates and valuation metrics.

Understanding Alta stock price fluctuations often requires considering related market trends. For instance, the performance of other energy companies, such as the current status of the alliance coal stock price , can offer valuable insight. This is because these companies often share similar economic sensitivities, impacting investor sentiment and ultimately influencing Alta’s stock price trajectory.

What is the current market capitalization of Alta?

The market capitalization fluctuates constantly and is readily available on financial news websites and stock market data providers.