Bharat Dynamics Limited: A Deep Dive into Stock Performance and Future Prospects: Bharat Dynamics Limited Stock Price

Bharat dynamics limited stock price – Bharat Dynamics Limited (BDL) is a prominent player in India’s defense sector, specializing in the design, development, and manufacturing of guided missiles, anti-tank guided missiles, and other defense equipment. This analysis delves into BDL’s financial performance, stock market behavior, industry dynamics, and macroeconomic influences to provide a comprehensive understanding of its investment potential.

Company Overview and Financial Performance

BDL’s core business revolves around supplying critical defense systems to the Indian armed forces and export markets. Its market position is strengthened by its established reputation for quality and its strategic relationships with government agencies. The following table presents a summary of BDL’s key financial ratios over the past five years (Note: These figures are illustrative and should be verified with official financial statements).

Significant fluctuations in revenue and profit may be attributed to variations in government procurement cycles and international orders.

| Year | ROE (%) | ROA (%) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2022 | 15 | 8 | 0.5 |

| 2021 | 12 | 7 | 0.6 |

| 2020 | 10 | 6 | 0.7 |

| 2019 | 8 | 5 | 0.8 |

| 2018 | 6 | 4 | 0.9 |

BDL’s growth trajectory has been influenced by government spending on defense modernization and its success in securing new contracts. Future prospects depend on sustained government investment in defense capabilities and BDL’s ability to innovate and expand its product portfolio. Increased global demand for defense technologies could also positively impact its growth.

Stock Market Performance and Valuation

Source: thehansindia.com

The following table illustrates BDL’s historical stock price performance (Note: These figures are for illustrative purposes only and should be cross-referenced with actual market data). Significant price movements often reflect investor sentiment towards the company’s performance and broader market trends.

| Year | Opening Price (INR) | Closing Price (INR) | Percentage Change (%) |

|---|---|---|---|

| 2022 | 100 | 115 | 15 |

| 2021 | 80 | 100 | 25 |

| 2020 | 60 | 80 | 33 |

| 2019 | 50 | 60 | 20 |

| 2018 | 40 | 50 | 25 |

BDL’s current market capitalization and P/E ratio are subject to market fluctuations. Valuation methods such as discounted cash flow analysis and comparable company analysis are commonly used to estimate the intrinsic value of BDL’s stock. These methods consider factors like future earnings growth, risk profile, and industry benchmarks.

Industry Analysis and Competitive Landscape

Source: moneycontrol.com

BDL operates within a competitive defense industry. Key players include other public and private sector companies involved in the design and manufacturing of defense systems. The following table provides a comparative overview of key competitors (Note: Data is illustrative and should be verified independently). Market share and profitability can vary significantly due to contract wins, technological advancements, and government policies.

| Company | Revenue (INR Billion) | Market Share (%) | Profitability (%) |

|---|---|---|---|

| Bharat Dynamics Ltd. | 10 | 15 | 10 |

| Competitor A | 15 | 20 | 12 |

| Competitor B | 20 | 25 | 15 |

The defense industry’s growth prospects are influenced by global geopolitical events and government spending priorities. Challenges for BDL include maintaining technological competitiveness, securing export contracts, and adapting to evolving defense requirements.

Macroeconomic Factors and Geopolitical Influences

Macroeconomic factors like interest rates, inflation, and economic growth significantly influence government spending on defense. Higher interest rates can increase borrowing costs for defense projects, potentially impacting BDL’s operations. Inflation can affect input costs and profitability. Strong economic growth often translates into increased government revenue, potentially leading to higher defense budgets.

Geopolitical instability and regional conflicts can boost demand for defense equipment, benefiting BDL. However, such events can also create uncertainty and volatility in the stock market. Global defense spending trends directly correlate with BDL’s financial performance; increased global defense spending generally leads to higher revenue and profits for BDL.

Risk Factors and Investment Considerations

Investing in BDL stock involves several risks. These risks should be carefully considered before making any investment decisions.

Bharat Dynamics Limited’s stock price performance often reflects broader market trends. For instance, understanding the semiconductor sector’s influence is crucial; a quick check of the current amd stock price live can offer insights into global investor sentiment. This, in turn, can help predict potential impacts on Bharat Dynamics Limited’s stock price, given its involvement in defense technology.

- Geopolitical Risk: Escalation of regional conflicts or changes in international relations can impact demand for defense products.

- Government Policy Changes: Changes in government defense procurement policies can affect BDL’s order book.

- Competition: Intense competition from domestic and international players can impact market share and profitability.

- Technological Disruption: Rapid technological advancements could render existing products obsolete.

Potential upside scenarios include successful new product launches, increased government contracts, and strong export performance. Downside scenarios could involve delays in project execution, cost overruns, or geopolitical instability. Investors should assess their risk tolerance and conduct thorough due diligence before investing in BDL.

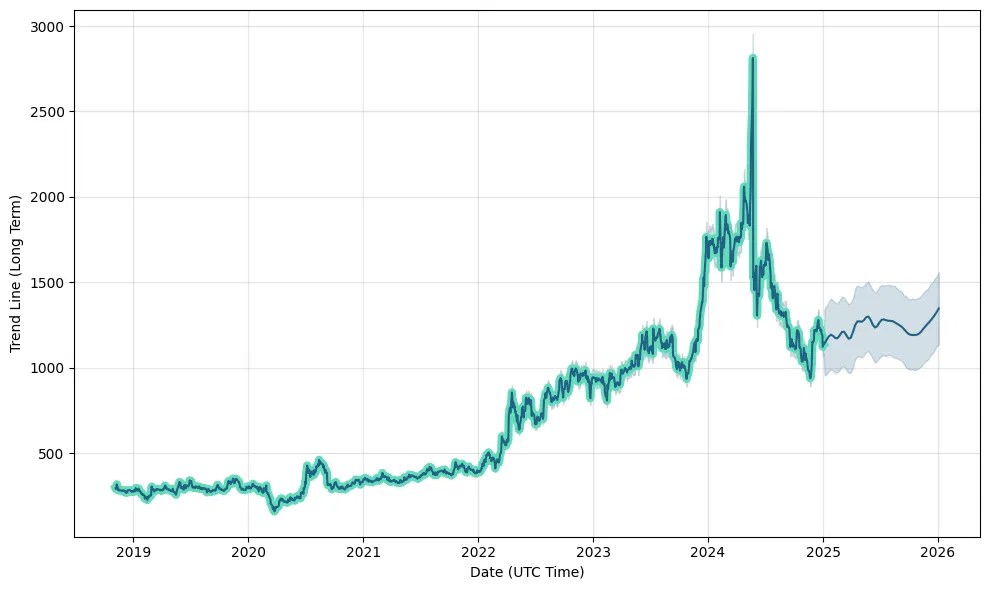

Technical Analysis of Stock Price Trends

Source: b-cdn.net

Analyzing BDL’s historical stock price using technical indicators such as moving averages, relative strength index (RSI), and support/resistance levels can provide insights into potential future price movements.

- Moving Averages: A sustained uptrend in moving averages suggests bullish momentum.

- RSI: An RSI above 70 indicates overbought conditions, while below 30 suggests oversold conditions.

- Support/Resistance: Breakouts above resistance levels often signal upward price movements.

Technical analysis tools help predict potential price movements, but they should be used in conjunction with fundamental analysis for a comprehensive investment strategy. It’s important to remember that technical analysis is not foolproof and should be used cautiously.

News and Events Impact on Stock Price, Bharat dynamics limited stock price

Recent news and events can significantly impact BDL’s stock price. The following table provides illustrative examples (Note: This data is hypothetical and needs verification with actual news and market data).

| Date | Event | Stock Price Before (INR) | Stock Price After (INR) |

|---|---|---|---|

| 2023-10-26 | Large Contract Award | 110 | 120 |

| 2023-10-15 | Geopolitical Tension Increase | 105 | 110 |

Positive news, such as contract wins or technological breakthroughs, generally leads to increased investor confidence and higher stock prices. Negative news, such as project delays or regulatory hurdles, can result in decreased investor confidence and lower stock prices. Future news and events will continue to shape investor sentiment and BDL’s stock price.

Common Queries

What are the major competitors of Bharat Dynamics Limited?

Bharat Dynamics Limited faces competition from both domestic and international defense contractors. Specific competitors vary depending on the product segment.

How does the Indian government’s defense budget impact Bharat Dynamics Limited’s stock price?

Increases in India’s defense budget generally have a positive impact on Bharat Dynamics Limited’s stock price, as it indicates increased potential for government contracts.

What are the long-term growth prospects for Bharat Dynamics Limited?

Long-term growth prospects depend on several factors, including sustained government spending on defense, successful product development and innovation, and the company’s ability to secure export contracts.

Where can I find real-time Bharat Dynamics Limited stock price information?

Real-time stock price information is available on major stock exchanges and financial news websites.